A Contingent Liability Should Be Recorded in the Accounts

This means that a loss would be recorded debit and a liability established credit in advance of. According to regulations financial liabilities that must be retained on long term debt must be recorded in account when these are likely to occur and a reasonable estimate of their.

Doc Assignment On Current Liabilities Contingent Liabilities Intermediate Accounting Rejan Protha Academia Edu

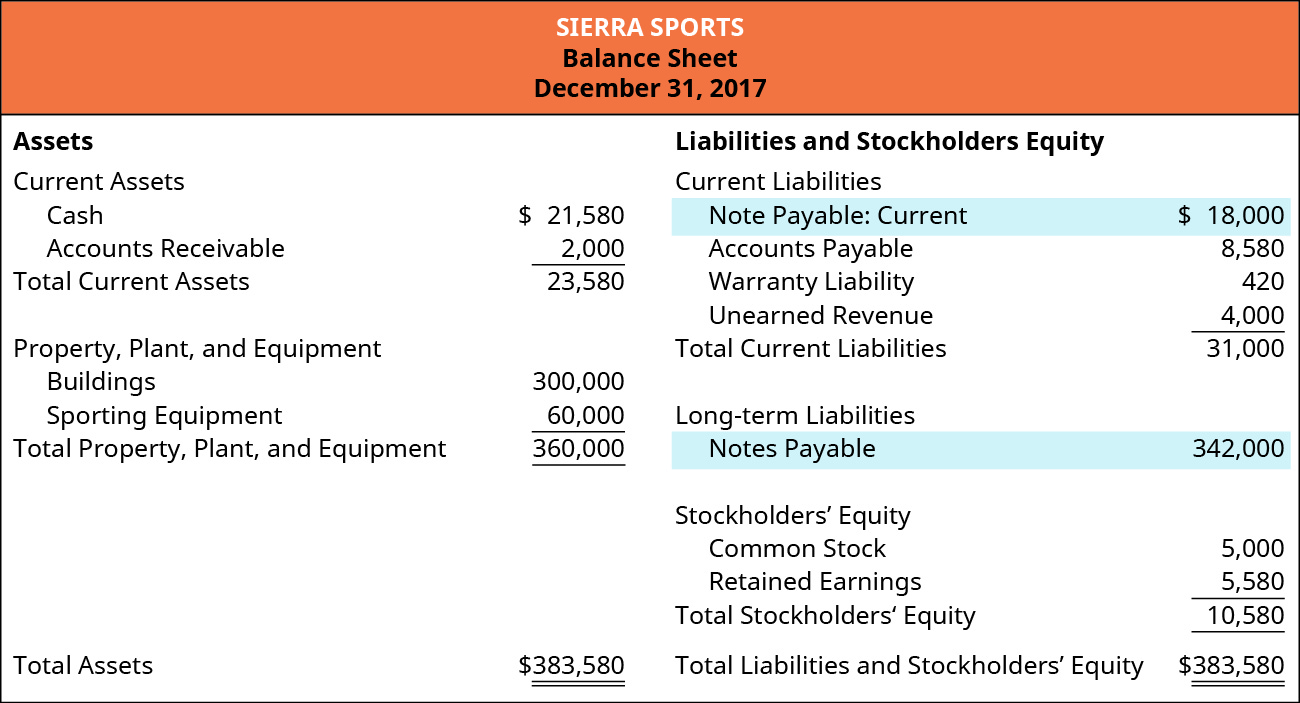

If the period of expected settlement is within one year of the balance sheet date the reporting entity should classify the contingency as a short-term liability.

. Bif the amount is due in cash within. Up to 25 cash back A contingent liability should be recorded in the accounts when. Either a or b.

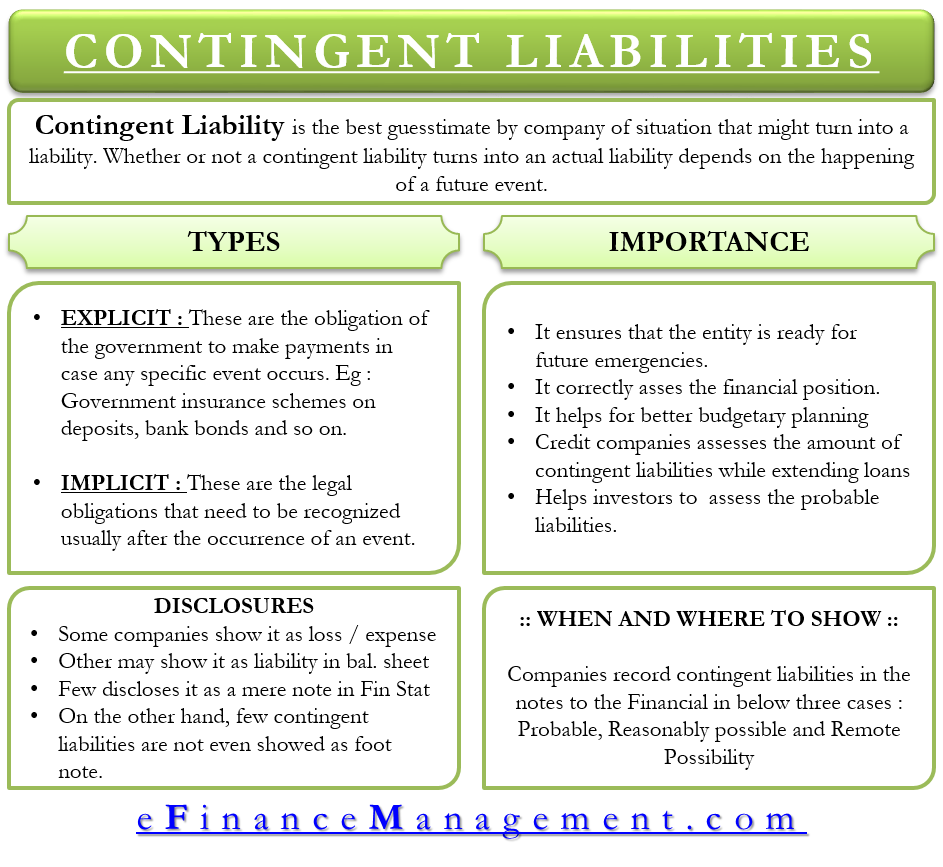

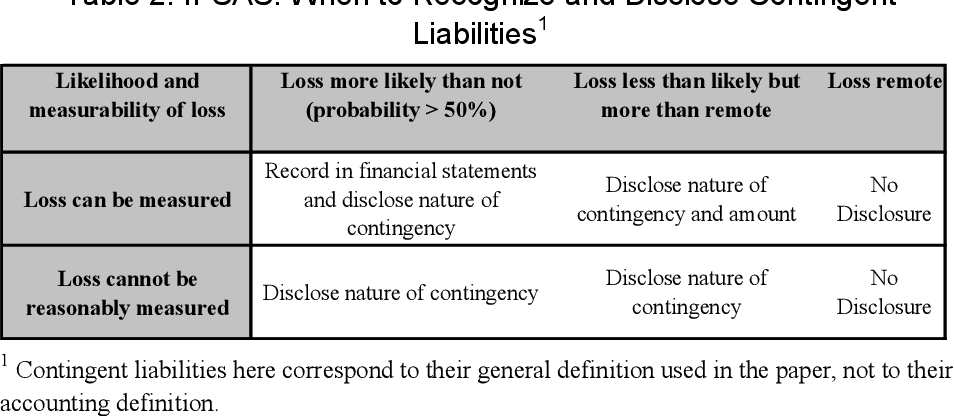

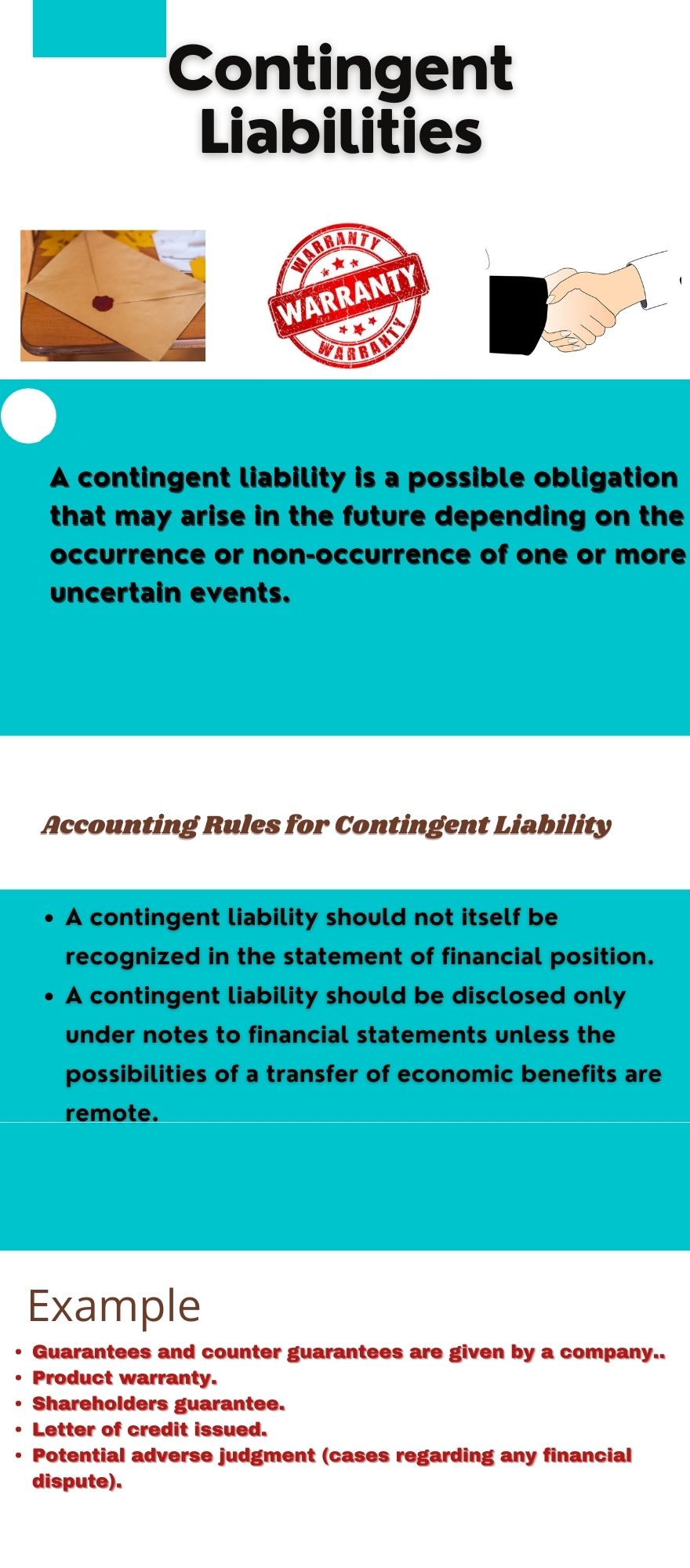

A contingent liability is recorded if the contingency is likely and the amount of the liability can be reasonably estimated. IAS 37 Provisions Contingent Liabilities and Contingent Assets states that the amount recorded should be the best estimate of the expenditure that would be required to settle the present obligation at the balance sheet date. They are noted below.

It is probable that the future event will occur. A potential or contingent liability that is both probable and the amount can be estimated is recorded as 1 an expense or loss on the income statement and 2 a liability on the balance sheet. Helping business owners for over 15 years.

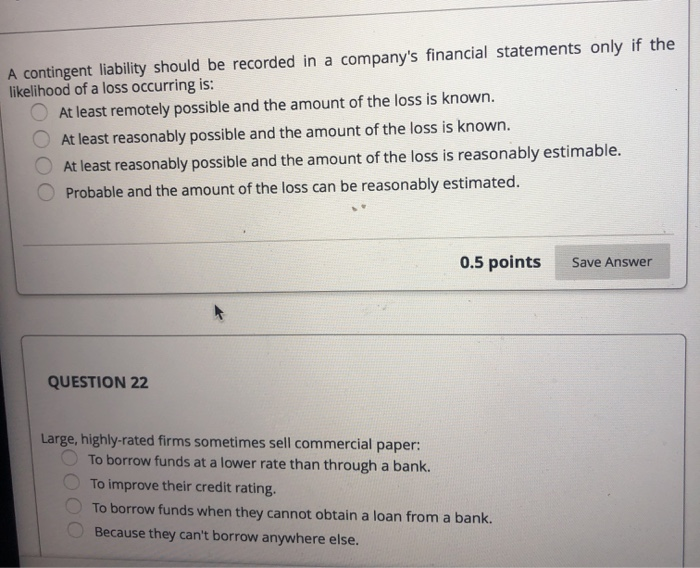

If the liability is probable or possible but the amount cant be determined or estimated it has to be disclosed in the footnotes to the financial statements. Correct - Your answer is correct. Rules specify that contingent liabilities should be recorded in the accounts when it is probable that the future event will occur and the amount of the liability can be reasonably estimated.

Abbott Corporation should accrue a contingent liability and loss of. All contingent liabilities should be reported as liabilities on the financial statements even those that are unlikely to occur. A contingent liability is a liability that may occur depending on the outcome of an uncertain future event.

Based on accounting rules. If you can only estimate a range of possible amounts then record that. 5 if the liability is probable and the amount can be reasonably estimated companies should record contingent liabilities in the accounts.

A True B False 2. The balance sheet classification of the accrual should consider when the contingency will be settled. In both the Profit and Loss Account as well as the Balance Sheet a contingent liability can be recorded as an expense.

There are three possible scenarios for contingent liabilities all of which involve different accounting transactions. It is reasonable possibly the contingency will happen and the amount can be reasonable estimated c. Examples of contingent loss situations are.

However since most contingent liabilities may not occur and the amount often cannot be reasonably estimated the accountant usually does not record them in the accounts. Disclosing a Contingent Liability. A contingent liability should be recorded in the accounts Aif the amount can be reasonably estimated.

Wrong - Your answer is wrong. The accounting for a contingency is essentially to recognize only those losses that are probable and for which a loss amount can be reasonably estimated. It is pobable the contingency will happen but the amount cant be reasonably b.

A subjective assessment of the probability of an unfavorable outcome is required to properly account for most contingences. When Should A Contingent Liability Be Recorded As A Liability. The amount of the liability can be reasonably estimated.

Record a contingent liability when it is probable that a loss will occur and you can reasonably estimate the amount of the loss. Recording a Contingent Liability. Dboth b and c.

Otherwise it should be classified as long-term. Contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will actually occur. Rules specify that contingent liabilities should be recorded in the accounts when it is probable that the future event will occur and the amount of the liability can be reasonably estimated.

If the proceeds from the sale of a plant asset exceed its book value a gain on disposal occurs A True B False 3. Abbott Corps attorney estimates that the company will ultimately have to pay between 350000 and 500000 relating to current litigation and that the most likely amount of the loss will be equal to 400000. The liability may be disclosed in a footnote on the financial statements unless both conditions are not met.

A contingent liability has to be recorded if the contingency is likely and the amount of the liability can be reasonably estimated. Record a Contingent Liability. Cif the related future event will probably occur.

Both a and b. A loss contingency which is possible but not probable will not be recorded in the accounts as a liability. It is probable the contingency will happen and that amount can be reasonable estimated d.

Instead firms typically disclose. Disclosure of a contingent liability is usually made A B C D parenthetically in the. According to FASB Statement No.

A contingent liability is recorded in the accounting records Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Bif the amount is due in cash within one year. A contingent liability should be recorded in the accounts Aif the amount can be reasonably estimated.

E option is correct Contingent liability should be recorded in the accounts If the related future event will probably occur and the amount can be reasonably estimated. These three core statements are if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy. Accounting For Contingent Liabilities.

This means that a loss. Contingent liabilities are those liabilities which have not arisen. Contingent liabilities should be recorded in the accounts when.

If the liability is probable and the amount can be reasonably estimated companies should record contingent liabilities in the accounts. Eboth a and c. In the world of finance contingent liability refers to the possibility that something might occur in the near future.

If the liability is contingent and certain amounts can be reasonably calculated then it should be recorded. Injuries that may be caused by a companys products such as when it is discovered that lead-based paint has been used on toys sold by the business. Thus the reporting of more contingent losses is likely under IFRS than currently under US.

A contingent liability should be disclosed in the notes to the financial statements if there is a reasonable possibility that a loss or expense will occur.

Contingent Liability Meaning Importance Types And More

Define And Apply Accounting Treatment For Contingent Liabilities Principles Of Accounting Volume 1 Financial Accounting

J 1 J 2 Learning Objectives Describe The Accounting And Disclosure Requirements For Contingent Liabilities 1 Discuss The Accounting For Lease Liabilities Ppt Download

Contigent Liabilities Meaning Types Examples Commerce Achiever Commerce Achiever

Solved A Contingent Liability Should Be Recorded In A Chegg Com

Define And Apply Accounting Treatment For Contingent Liabilities Principles Of Accounting Volume 1 Financial Accounting

Other Significant Liabilities Ppt Video Online Download

Long Term Liabilities Accounting Services

Contingent Liabilities Course Hero

Ias 37 Provisions Contingent Liabilities And Contingent Assets Ppt Video Online Download

What Is The Journal Entry To Record A Contingent Liability Universal Cpa Review

Contingent Liabilities Course Hero

Contingent Liabilities Should Be Recorded In The Accounts When Ictsd Org

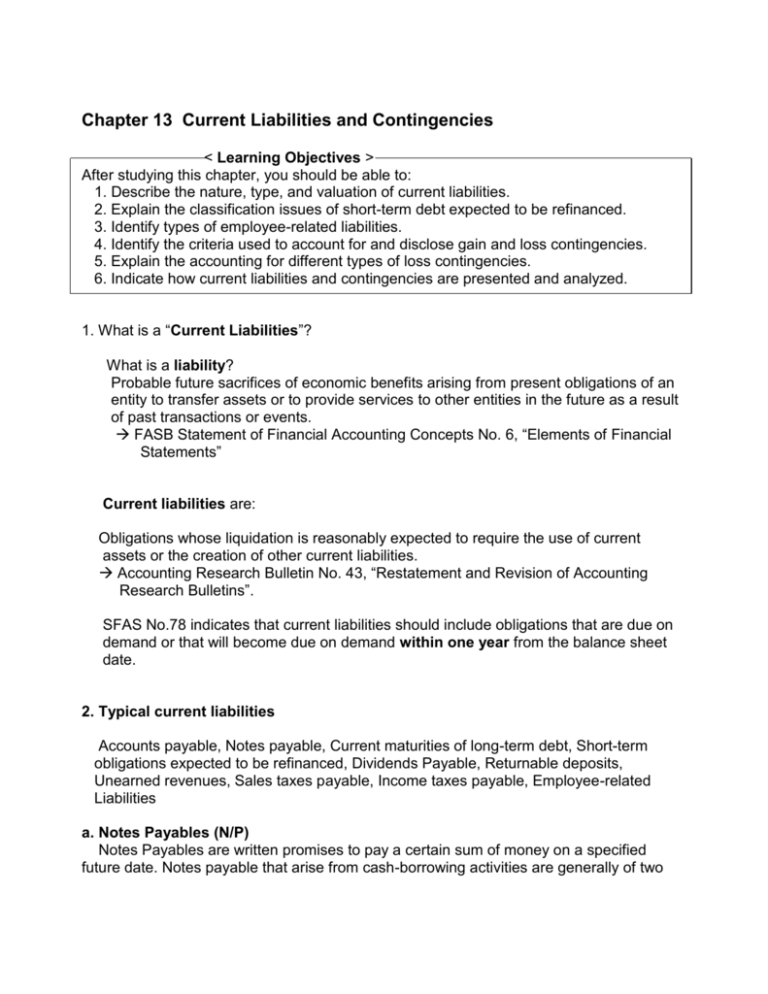

Chapter 13 Current Liabilities And Contingencies

Contigent Liabilities Meaning Types Examples Commerce Achiever Commerce Achiever

Contingent Liabilities Principlesofaccounting Com

Contingent Liabilities Principlesofaccounting Com

What Is The Meaning Of Contingent Liabilities And Its Examples

Comments

Post a Comment